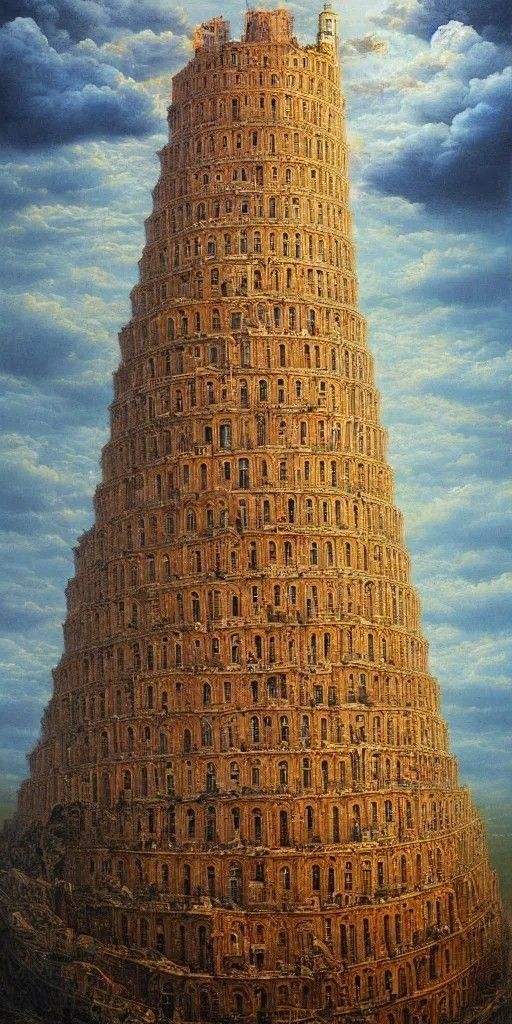

“Central banking has ancient roots, and many historians trace the origins of banking systems back to the Babylonian civilization, which developed some of the earliest forms of organized financial practices.

Babylonian Banking Practices:

Temples as Financial Hubs: In ancient Babylon (circa 2000 BCE), temples often functioned as early financial institutions. Temples were trusted institutions and served as safe places for deposits, much like modern banks today. Priests managed these deposits, including gold, silver, and grains, and would issue loans using these assets.

Loans and Interest: The Babylonians practiced lending at interest, a key feature of modern banking. Borrowers could receive grain, silver, or other valuable goods in exchange for future repayment, often with added interest. The Code of Hammurabi (circa 1754 BCE) laid out some of the first legal frameworks for managing debts, interest rates, and collateral.

Receipts and Promissory Notes: Babylonian merchants and individuals often used clay tablets to record transactions, including loans and deposits. These receipts functioned like promissory notes or early forms of checks.

Although Babylonian banking was not “central banking” in the modern sense, their practices laid the groundwork for structured financial institutions, which evolved into more complex systems, such as medieval European banking and, eventually, central banking models like the Bank of England (1694). The concept of a central authority regulating currency and interest rates would develop much later, but Babylonian practices demonstrate some of the earliest forms of organized banking.”

Leave a comment