Bitcoin’s public blockchain is essential to making sure the number of Bitcoins are not inflated. Unlike ribawi fiat currencies, where banks can create more money via riba credit expansion whenever they want (which leads to inflation), Bitcoin has a hard limit of 21 million coins. This cap is set and can’t be changed.

The 21 million Bitcoin cap is a fundamental part of its design, ensuring scarcity and maintaining trust in its value. Changing it would require consensus from the entire decentralized network, which is highly unlikely.

Every transaction is recorded on this public ledger that anyone can access, so there’s no way to sneakily create more Bitcoin. It’s all out in the open, which makes sure that Bitcoin can’t be devalued like fiat currencies when too much money gets printed / issued.

Now, while this transparency is great for keeping the money supply in check and preventing inflation, it also comes with a downside. A lot of people think Bitcoin is anonymous, but that’s only partly true. Every transaction is out there on the blockchain for anyone to see. Sure, the transactions are tied to addresses, not real names, but with some clever analysis, it’s possible to trace transactions and figure out who owns what, especially if you’ve used exchanges or services that require KYC ID.

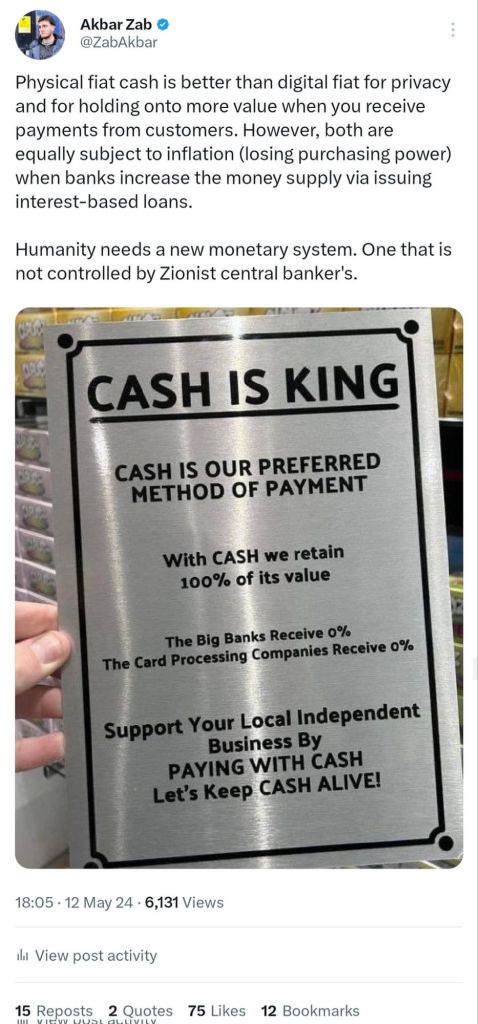

So, Bitcoin’s public ledger gives us this amazing system where the currency is secure and inflation-proof, but at the cost of privacy. It’s not as private as handing over physical fiat riba cash, where there’s no record of the transaction at all. In the end, it’s a bit of a balancing act—Bitcoin’s transparency keeps the system honest, but it also means that it’s not as private as people might wish.

Leave a comment