Saifedean Ammous:

“The IMF’s privatization programs replaced government monopolies with private monopolies, usually owned by the same people. As part of the debt relief deals signed with the misery industry, governments were asked to sell off some of their most prized assets. This included government enterprises, but also natural resources and entire swaths of land. The IMF would usually auction these to multinational corporations and negotiate with governments for them to be exempt from local taxes and laws.

After decades of saturating the world with easy credit, the IFIs spent the 1980s acting as repo men. They went through the wreckage of third-world countries devastated by their policies and sold whatever was valuable to multinational corporations, giving them protection from the law in the scrap heaps in which they operated. This reverse Robin Hood redistribution was the inevitable consequence of the dynamics created when these organizations were endowed with easy money.

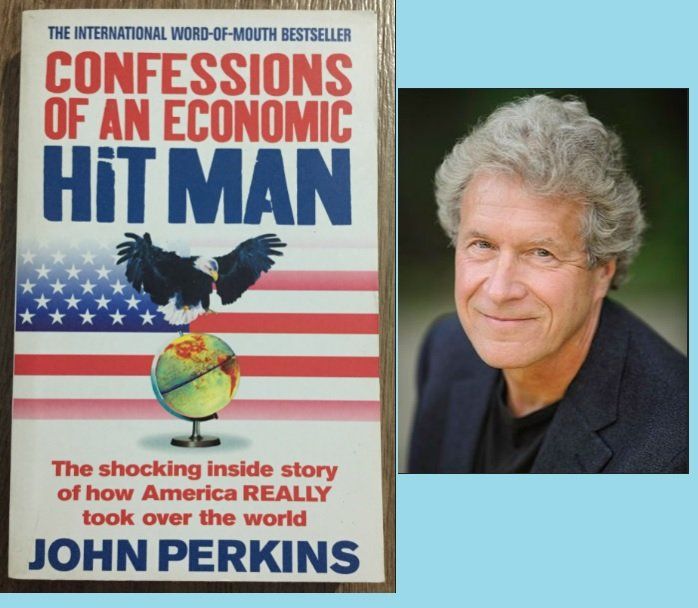

As part of these “free-market reforms,” the IMF would recommend imposing more taxes to close the budget gaps, using “free markets” as a cover to pass off its global fiat mining enterprise. The role of the IFIs as enablers for multinational corporations is something that has been repeated often by its leftist critics, such as John Perkins in his “Confessions of An Economic Hitman”.

While there is some kernel of truth to Perkins’s sensationalist stories, there is of course much that is missing. Having worked for these organizations for decades, Perkins’s critique is typical of the lefty fiat insiders who criticize these institutions while living off of their paychecks, concluding that the problem is that they are free-market institutions and the solution is more central planning.

In my estimation, approximately 90% of the people who work for international financial institutions can be classified as “leftist critics” of these institutions. American actor Joseph Stiglitz (Keynesian economist) has made a lucrative career from these organizations by playing the role of an economist who criticizes them, demanding they shift toward more central planning and debt financing, even as he collects paychecks from them.

The work of Perkins and many others clearly exposes how much large multinational corporations benefit from the special arrangements that the IFIs negotiate for them with developing countries. However, that cannot be understood as the root problem but rather as a symptom of it. The enormous power of a credit line from the U.S. Federal Reserve that gives these organizations power over developing countries also makes them ripe for capture by multinational companies looking to do business in the developing world.

Fiat economists lash out at multinational corporations as if Nike and McDonald’s are the most serious problems facing the third world, completely oblivious to the far more mendacious horror unleashed by the fiat debt that pays their salaries. This superficial ritual prevents them from coming to terms with harder questions:

Why is there a global lender of last resort in the first place?

Why do all the world’s governments have to get into debt?

Why should the IFIs get to plan economic development when the history of central planning is the history of comprehensive failure?

Contrary to Perkins’s vision, the problem is not that the IFIs allow free trade or free capital movement. The problem is that they control and centrally plan trade and investment and that their loans are impossible to repay. These problems do not start when the country defaults and needs a bailout; they start the moment that the first misery industry plutocrat sets foot in a country and begins to centrally plan its economy.”

The Fiat Standard: The Debt Slavery Alternative to Human Civilization | Book by Saifedean Ammous.

Download for FREE:

https://libgen.rs/book/index.php?md5=1F8DBCA7EC613F75CCC9961CF4961FFD

Leave a comment